The School of Economics, College of Humanities And Legal Studies has held a Public Lecture – in the words of the Dean of School of Economics: in order to blend theory and practical knowledge about tax administration and domestic revenue mobilization in Ghana.

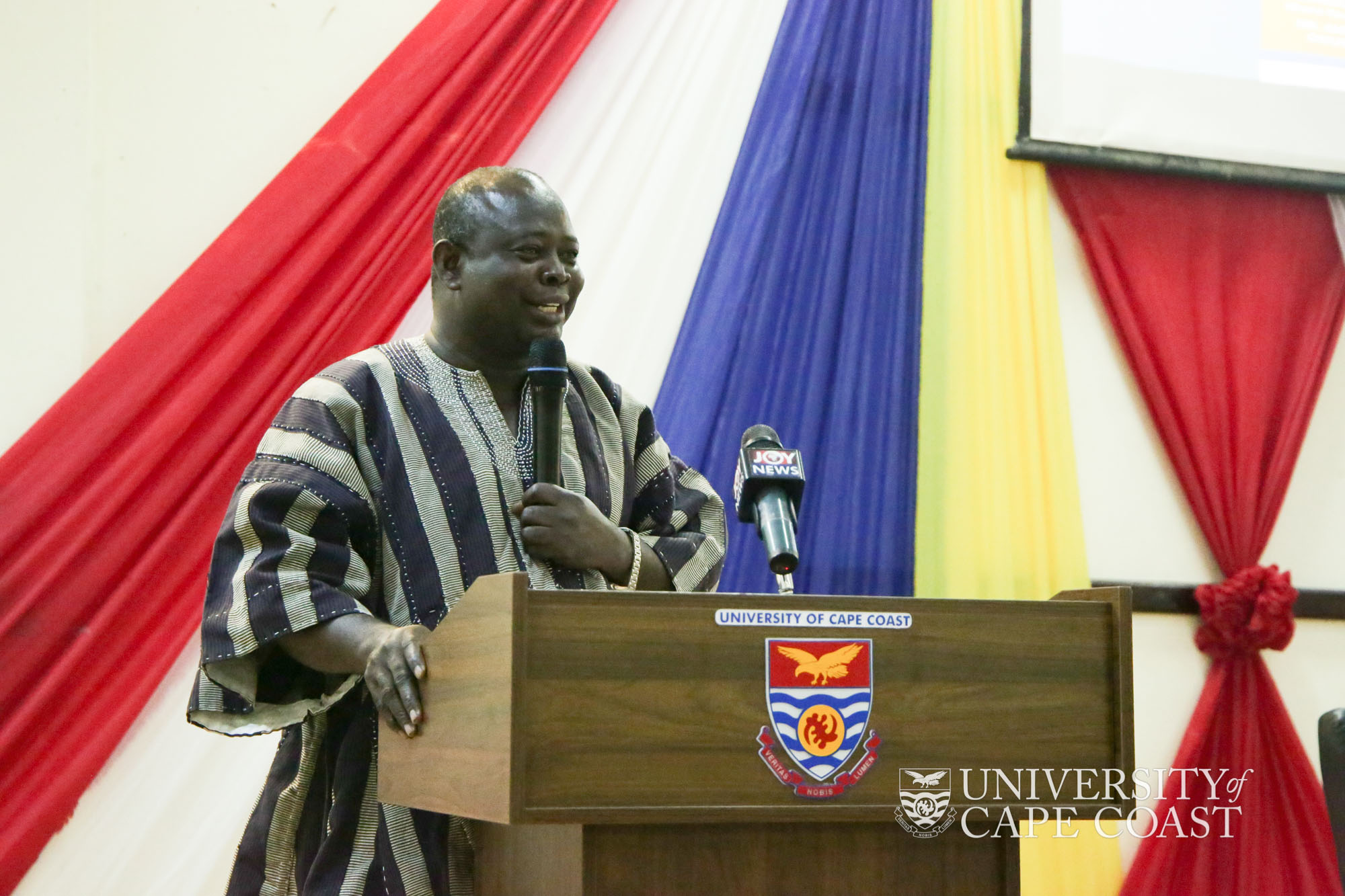

With the aim of breaching the gap between academia and the industry, the School of Economics invited the Commissioner-General from Ghana Revenue Authority (GRA) to speak on the topic “Tax Administration And Domestic Revenue Mobilization In Ghana”. The Assistant Commissioner from GRA, Mr. Dominic Naab represented the Commissioner-General and shared vital information from the field. He talked about the various types of taxes and tax refunding processes, what GRA is doing to help the tax payers through the covid-19 crisis, and reforms that have taken place, among others. He also elaborated on the importance of paying taxes and how it contributes to the building of the society.

The speaker touched on number of reforms in the sector; de-centralization of the tax payers, internal sanitization of the system. He also spoke about the available structures to make the tax payment less tasking for the task payer like the digital payment system and online tax engagement of tax payers. He also touched on tax education, the transparent audit system, the tax amnesty, private sector recovery levies, electric sector recovery levies, the oil industry and the mining sector.

Mr. Dominic responded to the questions of enthusiastic students and lecturers who had come in their numbers. Ms Nana Bireige Owusu Ansah, Head of Communication and Public Affairs, GRA, and Ms Sophia Bandful Godwyll, Chief Revenue Officer, Communication and Public Affairs, GRA, were also present to answer questions about taxation of allowances, taxation of the informal sector and online companies, among others.

Prof. Siaw Frimpong from Department of Finance chaired the function.